Real Claims Chase Sapphire Travel Insurance Guide

What’s Covered, What’s Not, and How to File a Claim - Real Experiences

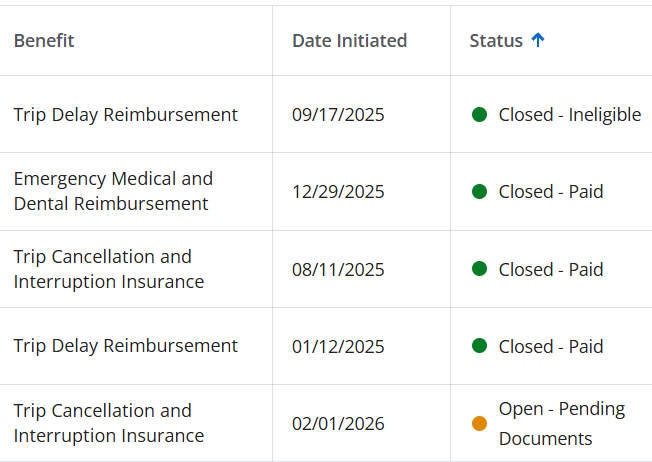

My personal claims with my Chase Sapphire Reserve Card in the past year

If you have a Chase Sapphire Preferred® or Chase Sapphire Reserve®, you’re sitting on some of the best built‑in travel insurance benefits of any credit card. The problem? Most people don’t know what’s actually covered — or how to use it when things go wrong. I personally use this card for all my travel-related expenses. I have also filed 5 claims in the past year, so I am very familiar with how these benefits work.

This guide breaks everything down in plain English:

What each card covers

Real‑life examples

How to file a claim

What documents you’ll need

When to use Chase vs. your airline or hotel

Tips to avoid denied claims

Whether you’re dealing with a delayed flight, lost luggage, or a trip cancellation, this is your go‑to resource.

This blog contains affiliate links. If you make a purchase, I may receive a commission (at no additional cost to you). Thanks for supporting NO POINT LEFT BEHIND — it helps me keep sharing savvy travel hacks and family adventures

👉Understand how points, miles, and credit card rewards actually work—explained in plain English.

⭐ Quick Summary: What Chase Sapphire Travel Insurance Covers

Both cards include coverage for:

Trip delay

Trip cancellation

Trip interruption

Lost or delayed luggage

Rental car insurance

The Reserve offers higher coverage limits, but both cards provide excellent protection.

✈️ Trip Delay Coverage

One of my many delays last summer. Stuck in Boston with my parents and son heading to London. No extra expenses out of pocket thanks to Chase Sapphire card.

If your flight is delayed due to weather, mechanical issues, crew problems, or other covered reasons, you may be reimbursed for:

Meals

Hotels

Transportation

Toiletries

Essentials

Preferred: Kicks in after 12 hours Reserve: Kicks in after 6 hours

Tip: Always keep receipts — even for small purchases. I have even been reimbursed for my margaritas at the airport!

My flight was cancelled during my cruise. Thanks to this benefit all my unexpected expenses in Miami were covered -> Cancelled flight claim Miami

🛑 Trip Cancellation & Interruption

If you need to cancel or cut a trip short due to:

Illness

Injury

Severe weather

Jury duty

Family emergencies

You may be reimbursed for:

Flights

Hotels

Tours

Prepaid activities

This is one of the most valuable benefits of both cards. I missed a cruise due to a weather delay and a cancelled flight. I was bummed I didn’t make my trip, but thanks to my Chase Sapphire card, I was reimbursed in full -> Chase Sapphire Travel Insurance Claim

🧳 Lost or Delayed Luggage

If your bags are delayed or lost, Chase may reimburse you for:

Clothing

Toiletries

Essentials

Replacement items

Tip: AirTags or Tile trackers make claims easier — and reduce stress.

🚗 Rental Car Insurance

Both cards include primary rental car coverage, meaning you can decline the rental agency’s insurance and still be protected for:

Theft

Damage

Collision

This alone can save you $20–$40 per day.

Emergency Medical & Evacuation Coverage (Reserve Only)

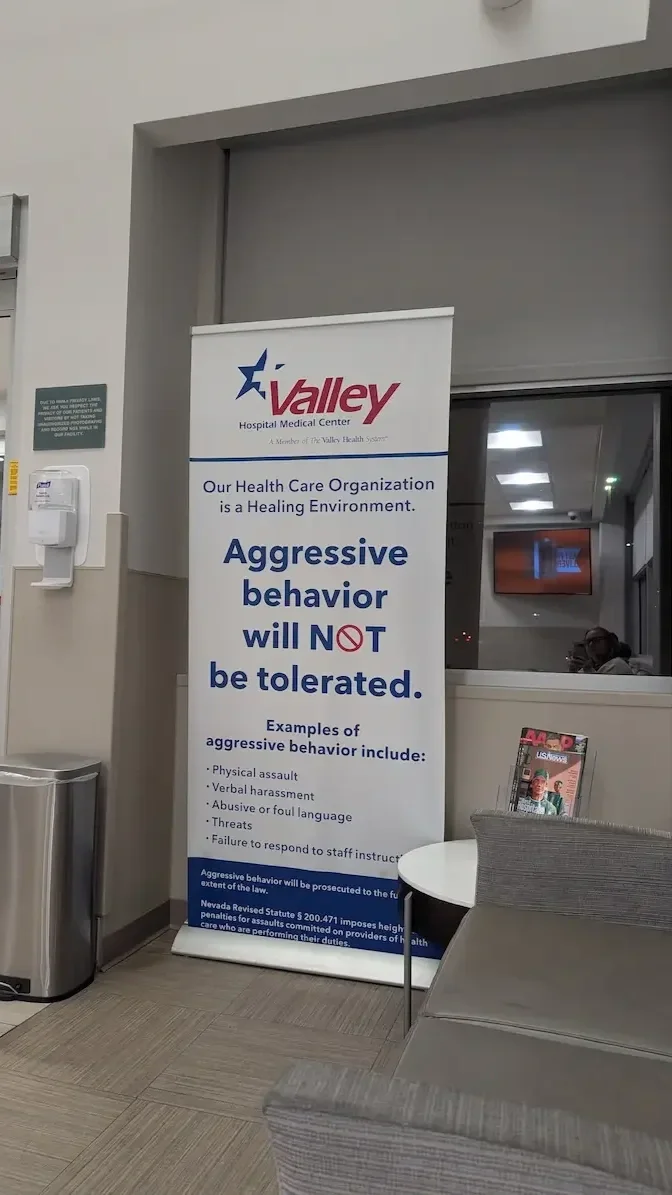

Emergency Room in Las Vegas

The Chase Sapphire Reserve® is the only Sapphire card that includes emergency medical benefits. This is a huge differentiator and one of the reasons the Reserve is so popular with frequent travelers.

What the Reserve Covers

Emergency medical treatment during a trip

Emergency dental treatment

Emergency evacuation to the nearest appropriate medical facility

Transportation after stabilization

Coverage Limits

Up to $2,500 for emergency medical/dental

Up to $100,000 for emergency evacuation

Who It’s For

Travelers who want built‑in medical protection without buying a separate policy — especially international travelers.

Important Note

The Chase Sapphire Preferred® does not include medical or evacuation coverage. If readers want this benefit, the Reserve is the only option.

This is not a replacement for full travel medical insurance, but it’s a strong safety net.

We personally used this coverage on our recent trip to Zion National Park -> Chase Sapphire Reserve Travel Insurance: My Medical Claim Story

📄 How to File a Chase Travel Insurance Claim

Filing a claim is easier when you know what to expect. Here’s the process:

1. Start your claim online

Go to the Chase Benefits Portal and select your card.

2. Upload documentation

Depending on the claim, you may need:

Flight delay or cancellation notice

Receipts for meals/hotels

Proof of payment with your Sapphire card

Doctor’s note (for medical cancellations)

Police report (for theft)

Airline baggage delay/loss report

3. Respond quickly to follow‑up requests

The claims team may ask for additional documents.

4. Track your claim status

Most claims resolve within 2–4 weeks.

⚠️ Common Reasons Claims Get Denied

Avoid these pitfalls:

Not paying for the trip with your Sapphire card

Missing receipts

Not submitting documentation on time

Filing with Chase before filing with the airline

Claiming non‑covered reasons (e.g., “I changed my mind”)

💡 Tips to Make Your Claim Go Smoothly

Screenshot delay notifications

Keep every receipt

File with the airline first

Use AirTags for luggage

Take photos of damaged items

Start your claim ASAP

💳 Which Chase Card Has the Best Travel Insurance?

Chase Sapphire Preferred®

Lower annual fee

Excellent coverage

Perfect for beginners

Chase Sapphire Reserve®

Higher coverage limits

Trip delay kicks in sooner

Better for frequent travelers

🔗 Related Guides You’ll Love

🧠 Final Thoughts

The Chase Sapphire cards offer some of the strongest built‑in travel protections available — and they can save you hundreds (or thousands) when things go wrong. Whether you’re dealing with a delay, cancellation, lost luggage, or a medical issue, knowing how your benefits work makes all the difference.

About the Author

Julie is a travel‑hacking expert and the founder of NO POINT LEFT BEHIND, a resource for families who want to turn everyday spending into unforgettable trips. She shares practical guides, points strategies, and real‑life travel experiences to help you maximize every dollar. Stay connected — follow Julie on Facebook for fresh travel tips and join the Travel Hacking Moms Facebook Group to be part of a supportive community of travelers learning together.