Chase Sapphire Reserve Travel Insurance Medical Claim

When a Zion National Park Trip Turns Into a Medical Detour

View from our hotel Zion National Park

Our Zion National Park getaway was supposed to be all about hiking, red rock views, and unplugged adventure. Instead, it came with an unexpected twist: my husband ended up needing medical care in Las Vegas — a detour no traveler wants to make.

Thankfully, my Chase Sapphire Reserve stepped in with its built‑in travel insurance benefits, turning what could’ve been a stressful, expensive situation into something manageable.

If you’ve ever wondered whether credit card travel insurance actually works, here’s a real‑world example.

Heads up: This post has affiliate links. If you use them, I earn a tiny commission — the kind that fuels coffee, not private jets. Thanks for supporting my travel‑obsessed corner of the internet.

The Chase Sapphire Reserve is one of my favorite cards for both earning points and protecting trips. 👉 See my full list of the Best Travel Cards for Families.

What Happened: Unexpected Medical Care While Traveling

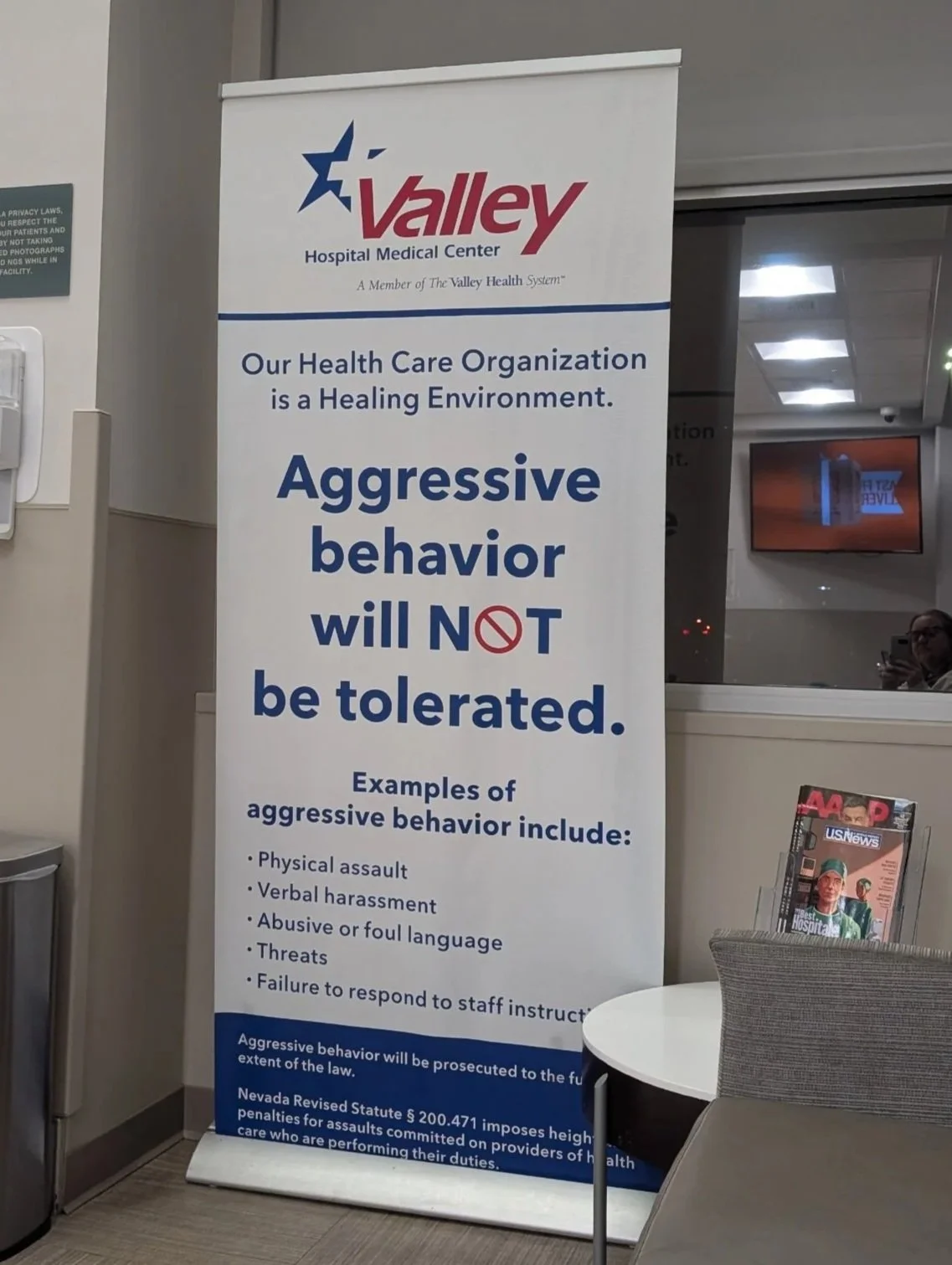

The first night of our trip, my husband needed to be seen by a medical provider in Las Vegas. Since we were traveling, we headed to urgent care at 2 am. Exactly where you want to be at 2 am in Las Vegas. We had flown in that evening and were heading to Zion National Park the next morning.

Emergency Clinic Las Vegas

Curious how Chase handles other types of claims? I also wrote about another real‑life Chase travel insurance claim so you can see exactly what the process looks like from start to finish. 👉 Read my other Chase claim experience

Here’s how the coverage played out:

How Chase Sapphire Reserve’s Medical Coverage Works

The Chase Sapphire Reserve includes Emergency Medical and Dental Benefits when you’re traveling more than 100 miles from home. It’s not a full replacement for health insurance — it’s designed to fill the gaps.

Here’s how my claim was processed:

Primary health insurance paid first. They covered the majority of the medical bill.

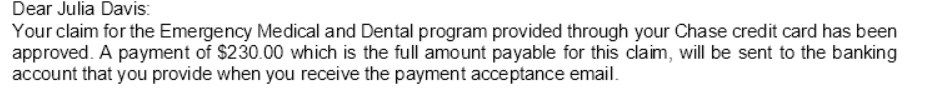

Chase Sapphire Reserve covered the remaining eligible amount. I submitted the leftover balance to Chase’s benefits provider.

A $50 deductible applied. My claim was approved and paid, minus the standard $50 deductible.

That’s it. No drama. No endless back‑and‑forth. Just layered coverage doing exactly what it’s supposed to do. I have filed several claims with my Chase Sapphire card, but this was my first medical claim. The process was very straightforward.

Claim Approval Letter Chase Sapphire Reserve

Filing a Travel Insurance Claim With Chase: What to Expect

If you ever need to file a claim, here’s what helped me:

1. Keep every receipt and document.

Urgent care paperwork, itemized bills, discharge notes — save it all.

2. File with your health insurance first.

Chase requires proof of what your primary insurance covers. I submitted our explanation of benefits for my proof.

3. Submit your Chase claim promptly.

The sooner you file, the faster it gets processed.

4. Expect the $50 deductible.

It’s small compared to what medical care can cost out of pocket.

5. Upload everything digitally.

The online claim portal is straightforward and keeps things moving.

Why This Coverage Matters for Travelers

Most people think of travel insurance as something you need for flight delays or lost luggage. But medical coverage is one of the most important protections you can have — especially if you’re:

Hiking national parks

Road‑tripping

Traveling internationally

Visiting remote areas

Traveling with kids or older family members

A simple urgent care visit can cost hundreds (or thousands) out of pocket. Having a card that fills the gaps is a game‑changer. Luckily, our claim was only $280, but that was an unexpected expense on our trip.

This wasn’t our first time filing a claim with Chase. If you want to see how another situation played out — including what was covered and how long it took — I’ve shared that story too. 👉 Check out my other Chase claim experience

Why I Keep the Chase Sapphire Reserve in My Wallet

The Chase Sapphire Reserve isn’t just about earning points — it’s about travel protection.

You get:

Emergency medical and dental coverage

Trip delay reimbursement

Trip cancellation/interruption coverage

Primary rental car insurance

Lost luggage reimbursement

Roadside assistance

It’s one of the few cards that consistently pays for itself through benefits alone.

👉 See my full list of the Best Travel Cards for Families to compare perks and find the right fit for your travel style.

Final Thoughts

Our Zion National Park trip didn’t go exactly as planned, but thanks to the Chase Sapphire Reserve, the unexpected medical detour in Las Vegas didn’t derail our budget. Travel insurance isn’t glamorous, but when you need it, it’s priceless.

About the Author

Julie is a travel‑hacking expert and the founder of NO POINT LEFT BEHIND, a resource for families who want to turn everyday spending into unforgettable trips. She shares practical guides, points strategies, and real‑life travel experiences to help you maximize every dollar. Stay connected — follow Julie on Facebook for fresh travel tips and join the Travel Hacking Moms Facebook Group to be part of a supportive community of travelers learning together.